Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☑ | ||||

Filed by a Party other than the Registrant ☐ | ||||

Check the appropriate box: | ||||

☐ | Preliminary Proxy Statement | |||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| Definitive Proxy Statement | ||||

☐ | Definitive Additional Materials | |||

☐ | Soliciting Material Pursuant to §240.14a-12 | |||

| NU SKIN ENTERPRISES, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check | ||||

| No fee | ||||

☐ | ||||

Fee paid previously with preliminary materials | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 | |||

|

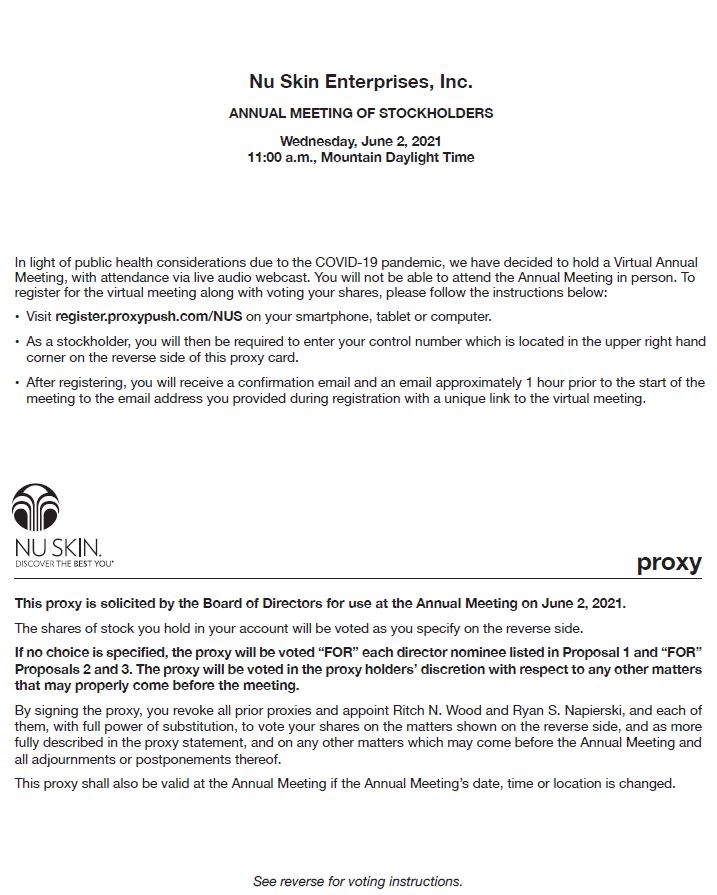

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF NU SKIN ENTERPRISES, INC. |

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Nu Skin Enterprises, Inc., a Delaware corporation, will be held at 11:00 a.m., Mountain Daylight Time, on June 2, 2021. 5, 2024, at our corporate offices, 75 West Center Street, Provo, Utah 84601.

At the Annual Meeting, you will be asked to consider and vote on the following matters, which are more fully described in the proxy statement:

| 1. | To elect the |

| 2. | To hold an advisory vote to approve our executive compensation; |

| 3. |

| 4. | To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for |

| 5. | To transact such other business as may properly come before the Annual Meeting. |

The Board of Directors has fixed the close of business on April 5, 2021,8, 2024 as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

You are cordially invited to attend the Annual Meeting in person. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on June 2, 2021:

| By Order of the Board of Directors, | |

| |

| |

| STEVEN J. LUND | |

| Chairman of the Board | |

Provo, Utah April 12, 2024 | |

|

| PROXY SUMMARY |

The following summary provides quick information for purposes of Nu Skin’s 20212024 Annual Meeting. It does not contain all of the information provided elsewhere in the proxy statement; therefore, you should read the entire proxy statement carefully before voting. This proxy statement and form of proxy are first being sent or given to our stockholders on or about April 21, 2021.25, 2024.

annual meeting information

| Date: | June |

| Time: | 11:00 a.m., Mountain Daylight Time |

| Location: | Nu Skin Corporate Offices, 75 West Center Street, Provo, Utah 84601 |

| Record date: | April 8, 2024 |

proposals

| Proposal | Board Recommendation | More Information | |

| Election of the | For each director nominee | Page 3 | |

| 2. | Approval of our executive compensation* | For | Page |

| 3. | Approval of our 2024 Omnibus Incentive Plan | For | Page 55 |

| 4. | Ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for | For | Page |

* Advisory vote

Corporate Governance and Compensation Highlights

See pages 87 and 21,23, respectively.

Board Composition

|  |  |  |  |  |  |  |  | |

| Skills and Experience | |||||||||

| Other public company board/exec. experience | • | • | • | • | • | • | |||

| Corporate finance/transactions | • | • | • | • | • | ||||

| International experience/global operations | • | • | • | • | • | • | • | ||

| Government relations | • | ||||||||

| Regulatory | • | • | |||||||

| Risk management | • | • | • | • | |||||

| Sales/marketing | • | • | • | • | • | ||||

| Online or digital marketing | • | • | • | ||||||

| Strategic planning | • | • | • | • | • | • | • | ||

| Current Nu Skin Committee Service (C = Chair) | |||||||||

| Audit Committee | • | • | • | C | |||||

| Compensation and Human Capital Committee | C | • | • | • | |||||

| Nominating and Corp. Governance Committee | • | • | C | • | • | ||||

| Demographics | |||||||||

| Race/Ethnicity – 22% diverse | |||||||||

| Asian | • | ||||||||

| Black or African American | • | ||||||||

| White/Caucasian | • | • | • | • | • | • | |||

| Gender – 33% diverse | |||||||||

| Female | • | • | • | ||||||

| Male | • | • | • | • | • | ||||

| Age | 63 | 69 | 72 | 70 | 50 | 66 | 79 | 44 | 72 |

| Other Characteristics | |||||||||

| Independence | • | • | • | • | • | • | • | ||

| Tenure (years) | 3 | 27 | 25 | 28 | 3 | 5 | 16 | 8 | 9 |

| Skills and Experience | |||||||||

| Other public company board/exec. experience | • | • | • | • | • | • | |||

| Corporate finance/transactions | • | • | • | • | • | ||||

| International experience/global operations | • | • | • | • | • | • | • | ||

| Government relations | • | ||||||||

| Regulatory | • | • | |||||||

| Risk management | • | • | • | • | |||||

| Sales/marketing | • | • | • | • | • | ||||

| Online or digital marketing | • | • | • | ||||||

| Strategic planning | • | • | • | • | • | • | • | ||

| Current Nu Skin Committee Service | |||||||||

| Audit Committee | • | • | • | ||||||

| Executive Compensation Committee | • | • | • | • | |||||

| Nominating and Corp. Governance Committee | • | • | • | • | |||||

| Other Characteristics | |||||||||

| Independence | • | • | • | • | • | • | • | ||

| Gender diversity | • | • | • | ||||||

| Racial/ethnic diversity | • | • | |||||||

| Age | 60 | 66 | 69 | 67 | 47 | 63 | 76 | 41 | 69 |

| Tenure (years) | 0 | 24 | 22 | 25 | 0 | 2 | 13 | 5 | 6 |

| Current Directors | Director Nominees | ||

| Average Tenure | 13 years | 11 years | |

| Average Age | 63 | 62 | |

| Independence |  |  | |

| Committee Independence |  |  | |

| Gender Diversity |  |  | |

| Racial/Ethnic Diversity |  |  |

Table of Contents

| 1 | ||

| 1 | ||

| 3 | ||

| 9 | ||

| Cybersecurity and Privacy | 9 | |

| Human Capital Management | 10 | |

| 11 | ||

| 12 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| Director Compensation | ||

| 49 | ||

| Proposal 2: Advisory Vote To Approve Our Executive Compensation | ||

| 55 | ||

| Proposal 4: Ratification of Selection of Independent Registered Public Accounting Firm | ||

| A-1 | ||

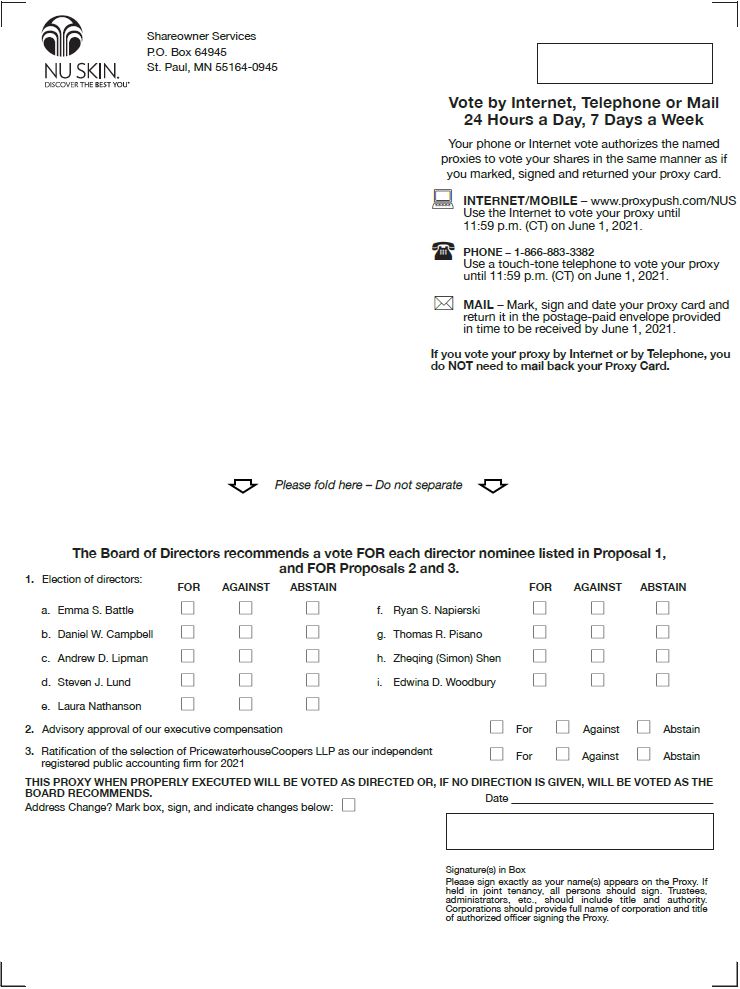

| Form of Proxy Card | ||

| PROXY STATEMENT |

The accompanying proxy is solicited on behalf of the Board of Directors of Nu Skin Enterprises, Inc. (“Nu Skin,” “we,” “us,” or “the company”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) on June 2, 2021,5, 2024 at 11:00 a.m., Mountain Daylight Time, and at any adjournment or postponement thereof. Due to the COVID-19 pandemic, theThe Annual Meeting will be held virtually, with attendance via live audio webcast. You will not be able to attend the Annual Meeting in person.at our corporate offices, 75 West Center Street, Provo, Utah 84601.

At the Annual Meeting, you will be asked to consider and vote on the following matters, which are more fully described in this proxy statement:

| 1. | To elect the |

| 2. | To hold an advisory vote to approve our executive compensation; |

| 3. |

| 4. | To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for |

| 5. | To transact such other business as may properly come before the Annual Meeting. |

This proxy statement and form of proxy are first being sent or given to our stockholders on or about April 21, 2021. 25, 2024.

We will bear the cost of solicitation of proxies. Expenses include reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation material regarding the Annual Meeting to registered and beneficial owners of our voting stock. Our regular employees may further solicit proxies by telephone, by mail, in person or by electronic communication and will not receive additional compensation for such solicitation.

VOTING PROVISIONS

Record Date; Shares Outstanding.

Only stockholders of record at the close of business on AprilHow Proxies Will Be Voted.

All shares represented by each properly executed, unrevoked proxy received in time for the Annual Meeting will be voted as directed by the stockholder. Each stockholder may appoint only one proxy holder or representative to attend the meeting on his or her behalf. In the absence of specific instructions, proxies will be voted in accordance with the Board of Directors’ recommendations “FOR” the election of each director nominee and “FOR” Proposals 2, 3 andRevocability of Proxy.Any proxy duly given pursuant to this solicitation may be revoked by the person or entity giving it at any time before it is voted by delivering a written notice of revocation to our Corporate Secretary, by executing a later-dated proxy and delivering it to our Corporate Secretary, or by voting at the Annual Meeting (although attendance at the Annual Meeting will not in and of itself constitute a revocation of the proxy). If you hold shares through a broker, bank or other nominee, you must follow the instructions of your broker, bank or other nominee to change or revoke your voting instructionsinstructions.

Attending and Voting at the Annual Meeting.

Quorum.

In order to constitute a quorum for the conduct of business at the Annual Meeting, a majority of the issued and outstanding shares of the Class A Common Stock entitled to vote at the Annual Meeting must be represented, either in person or by proxy, at the Annual Meeting. Under Delaware law, shares represented by proxy that reflect abstentions or “broker non-votes” (which are shares held by a broker or nominee that are represented at the Annual Meeting, but with respect to which such broker or nominee is not permitted to vote on a particular proposal without instructions from the beneficial owner and instructions are not given) will be countedVoting Standards and Effects.

| – | Proposal 1. |

| – | Proposals 2 and |

PROPOSAL 1:

ELECTION OF DIRECTORS

Directors are elected at each annual meeting of stockholders and hold office until their successors are duly elected and qualified at the next annual meeting of stockholders or until their earlier death, resignation or removal. Our Bylaws provide that the Board of Directors will consist of a minimum of three and a maximum of fifteen directors, with the number being designated by the Board. The current number of authorized directors is eight,nine, but it will increasedecrease to nineeight at the time of the director elections at the Annual Meeting.Meeting due to the retirement of Andrew D. Lipman. The Board has decided not to replace the seat vacated by Mr. Lipman at this time.

Set forth below are the name, age as of April 1, 2021,2024, business experience and other qualifications of each of our nineeight director nominees, listed in alphabetical order. Each of the nomineesnominee is a current director and was elected at our 20202023 annual meeting of stockholders, except for Emma S. Battle and Ryan S. Napierski. Ms. Battle was recommended by Edwina D. Woodbury, one of our independent directors.stockholders. We are not aware of any family relationships among any of our directors, director nominees or executive officers.

As previously disclosed, in February 2021, Ritch N. Wood notified our BoardMr. Lipman has informed us that he will step down as our Chief Executive Officer, effective September 1, 2021, and will therefore not stand for reelection toretire from the Board at the time of the Annual Meeting.Meeting and will not stand for re-election. Our Board extends gratitude to Mr. WoodLipman for his contributions and many years of service to our company in several roles, including Chief Executive Officer, Chief Financial Officer and a member of our Board. Upon Mr. Wood's retirement, Mr. Napierski will become our Chief Executive Officer.Nu Skin.

| Emma S. Battle | |

| Director | Compensation and Human Capital Committee (Chair) Nominating and Corporate Governance Committee |

Emma S. Battle, Ms. Battle is a successful businessperson with an extensive background in digital and online marketing, marketing analytics, and business and marketing strategy, which is valuable to the Board |

| Daniel W. Campbell | ||

Director since 1997 | Lead Independent Director Audit Committee Compensation and Human Capital Committee | |

Daniel W. Campbell, Mr. Campbell is a recognized business leader with expertise in the areas of finance, accounting, transactions, corporate governance and management. He has served on the boards of several other private and public companies. In addition, through his experience as a partner of an international accounting firm, and later as Chief Financial Officer of a large technology company, Mr. Campbell has developed deep insight into the management, operations, finances and governance of public companies. |

| Steven J. Lund | |

Director since 1996 (includes three-year leave of absence) | Executive Chairman of the Board |

Steven J. Lund, Mr. Lund brings to the Board over 35 years of company and industry knowledge and experience as a senior executive, including service as our General Counsel, Executive Vice President, and President and Chief Executive Officer. He played an integral role in managing our growth from start-up through his term as President and Chief Executive Officer. Mr. Lund also served on the Executive Board of the | |

| Ryan S. Napierski | |

| Director | President and Chief Executive Officer |

Ryan S. Napierski, |

| Mr. Napierski brings to the Board a strong expertise in direct sales, including through digital and social media platforms. | |

| Laura Nathanson | |

| Director since 2019 | Compensation and Human Capital Committee Nominating and Corporate Governance Committee (Chair) |

Thomas R. Pisano | |

Director since 2008 | Audit Committee Compensation and Human Capital Committee |

Thomas R. Pisano, Mr. Pisano is an experienced senior executive who is an expert in the direct selling, personal care, beauty products and other consumer goods industries. During his 25-year career at Avon, he was responsible for global new business development, which included new geographic market openings and launching new product lines globally. He was also responsible for the operation of international businesses in Latin America, Europe and Asia. During his international business career at Avon, Topps and OMSC, he traveled to and conducted business in approximately 50 countries. | |

| Zheqing (Simon) Shen | |

| Director since 2016 | Nominating and Corporate Governance Committee |

| Edwina D. Woodbury | |

| Director since 2015 | Audit Committee (Chair) |

Nominating and Corporate Governance Committee | |

Edwina D. Woodbury, Ms. Woodbury has extensive experience and understanding of our industry. While serving in various roles of increasing responsibility during her 21 years at Avon, she gained an in-depth understanding of the financial and internal control-related issues associated with global companies in our industry. She also brings to the Board valuable perspective from her service on other public company boards. While serving on the boards |

———————————————

Each nominee was recommended by the Nominating and Corporate Governance Committee for election and has consented to being named in thisany proxy statement for the Annual Meeting and to serve if elected. Although we do not know of any reason for which any nominee might become unavailable to serve on the Board, if that should happen, the Board may designate a substitute nominee. Shares represented by proxies will be voted for any substitute nominee so designated.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE NINEEIGHT NOMINEES TO OUR BOARD OF DIRECTORS.

CORPORATE GOVERNANCE

Corporate Governance Highlights

Board of Directors Independence and Committee Structure

| – | Separate Chairman of the Board and CEO.The positions of Chairman of the Board and CEO are filled by Mr. Lund and Mr. |

| – | Lead Independent Director.Our independent directors have designated Mr. Campbell as Lead Independent Director. |

| – | Limitation on Management Directors.All of our current directors are independent of the company and management except for Mr. Lund, who is one of our company’s founders, and Mr. |

| – | Meetings of Independent Directors.All independent directors meet regularly in executive session. Mr. Campbell, the Lead Independent Director, chairs these sessions. |

| – | Independent Committees.Only independent directors serve on our Audit, |

| – | Annual Board and Committee Performance Evaluations.The performance of the Board and each Board committee is evaluated |

Election of Directors

| – | Annual Election of Directors.All of our directors are elected annually; we do not have a staggered board. |

| – | Majority Voting in Uncontested Director Elections and Resignation “Our Director Nomination Process.” |

| – |

Stock-Related Matters

| – | Equity Retention Requirements.We have equity retention requirements that apply to our directors and executive officers, designed to align directors’ and executive officers’ interests with those of stockholders. For a description of these requirements, see “Executive Compensation: Compensation Discussion and |

| – | Hedging Policy.Our directors and employees, including officers, are prohibited from engaging in any hedging transactions with respect to our securities, including through the use of short sales, put options and financial instruments such as prepaid variable forward contracts, equity swaps, collars and exchange funds. This prohibition applies regardless of whether the director’s or employee’s securities were granted as compensation and regardless of whether the director or employee holds the securities directly or indirectly. |

| – | Pledging Policy.Our directors and employees, including officers, are prohibited from pledging their securities in our company. |

Director Independence

Our Corporate Governance Guidelines provide that at least 75% of our Board of Directors will consist of independent directors. The Board has determined that each of the current directors listed below is an “independent director” under the listing standards of the NYSE.independent.

| Emma S. Battle | Daniel W. Campbell | Andrew D. Lipman | |

| Laura Nathanson | |||

| Thomas R. Pisano | Zheqing (Simon) Shen | ||

| Edwina D. Woodbury |

In assessing the independence of the directors, in accordance with the NYSE listing standards, the Board determines whether or not any director has a material relationship with us, (eithereither directly or as a partner, stockholder or officer of an organization that has a relationship with us).us. The Board considers all relevant facts and circumstances in making independence determinations, including the existence and scope of any commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. In addition, as described in our Corporate Governance Guidelines, the Board will not consider a director to be independent if either the director or any immediate family member of the director (1) has been employed by our company or any of our subsidiaries or affiliates within the last five calendar years; (2) has served as an interim officer of our company or any of our subsidiaries or affiliates within the last three years; (3) has a personal services contract with our company or any member of our senior management; or (4) is employed as an executive officer by a private or public company at which an executive officer of our company serves as a director.

Board Leadership Structure

We currently separate the roles of Chairman of the Board and CEO. However, the Board has not adopted a policy with regard to whether the same person should serve as both the Chairman of the Board and CEO or, if the roles are separate, whether the Chairman of the Board should be selected from the non-employee directors or should be an employee. The Board believes it is most appropriate to retain the discretion and flexibility to make such determinations at any given point in time in the way that it believes best to provide appropriate leadership for the company at that time.

We have determined that our current separation of the roles of Chairman of the Board and CEO is appropriate given the differences in the roles and duties of the two positions and the individuals currently serving in these positions. The Board believes that separating these two positions (1) improves the ability of the Board to exercise its oversight role over management and provides multiple opportunities for discussion and evaluation of management decisions and the direction of the company; and (2) allows our CEO to focus on managing our day-to-day global business operations and on developing and implementing our business strategies and objectives. Both the current Chairman and the current CEO have long histories with our company, and the Board believes that its leadership structure makes the best use of their combined extensive knowledge of our company, industry and sales force.

The Board has created the Lead Independent Director position to provide independent leadership of the Board’s affairs on behalf of our stockholders and to promote openstockholders. This position ensures that an established channel of communication amongfor the independent directors.directors is maintained; it serves to strengthen communications both among independent directors and between senior management and the Board. Our Corporate Governance Guidelines provide that the Lead Independent Director (i) is designated by the non-management directors; (ii) consults with the Chairman of the Board and the CEO regarding agenda items for Board meetings; (iii) chairs executive sessions of the Board’s independent directors; and (iv) performs such other duties as the Board deems appropriate.

From time to time, the Board may consider electing an independent Chair or combining the roles of Chair and CEO. Such a decision would consider the composition of the Board at that time, including Board members’ expertise, experience and qualifications, as well as any stockholder input or other factors deemed appropriate by the Board.

Risk Oversight

We face a broad array of risks as outlined in our Annual Report on Form 10-K, including operational, strategic, legal and regulatory, financial, and other risks. Our management is responsible for establishing and maintaining systems to manage these risks. The Board exercises oversight over our management’s enterprise risk management program. The Board administers this risk oversight function as a whole and through its committees.

Management-Level Risk Management.We have established a global enterprise risk management (“ERM”) program, which is led by our Chief Audit and Compliance Officer and Vice President of Enterprise Risk (“CCO”). Our Risk Council, which consists of our CCO, CEO, CFO, General Counsel and other key members of our senior management, oversees and monitors the activities of our ERM program and reviews, on a regular basis, the top current and emerging enterprise risks we face, as well as relevant risk mitigation activities. The Risk Council considers the risks facing our company, including both short-term and long-term risks, and manages the risks according to their immediacy, potential impact, likelihood and other relevant factors. The CCO and other members of our management, including owners of various risk areas, are consulted as part of our disclosure controls and procedures as we prepare our public disclosures about the material risks we face as a company.

Board and Committee Roles in Risk Oversight.The CCO has a direct reporting relationship with our Audit Committee, which has responsibilities for risk oversight pursuant to its charter and NYSE listing standards. The CCO meets with the Audit Committee annually to discuss our ERM program and processes and the Risk Council’s recommendations regarding which risks warrant Board-level oversight.

Our Board of Directors has primaryretains direct oversight responsibility for risk oversight. Exceptcertain material risks that are fundamental to our business and strategy, such as regulatory risks associated with regard to certain strategically significantour sales compensation program and risks associated with our key strategic initiatives. For other risks, the Board administers its risk oversight function through the Audit Committee, Nominating and Corporate Governance Committee, and Executive Compensation and Human Capital Committee. The committee charters include the following subject-matter parameters for risk oversight:

| Audit Committee | Nominating and Corporate Governance Committee | and Human Capital Committee | |||

– Major financial risk exposures | |||||

– Operational risks related to information systems, information security and – Public disclosure and investor-related risks | – Corporate governance risks – Operational risks not assigned to the Audit Committee – Reputational risks | – Compensation practices-related risks – Human resources risks | |||

The committees, or the Board in the case of risks it determines to oversee directly, are responsible for overseeing and discussing with management our risk assessment and risk management programs and plans. Management periodically reportsIn these discussions, applicable members of management report to the Board or applicable committee on our risks and the internal processes, practices and controls attendant to the risks. These reports are coordinated through the CCO and generally occur annually or on a different cadence determined by the Board or committee. Following these reports by management, the Audit Committee periodically receives reports regarding the Nominating and Corporate Governance Committee’s and Executive Compensation and Human Capital Committee’s risk-oversight efforts.

Cybersecurity and Privacy

Our Board directlyAudit Committee oversees cyber and privacy-related risks and periodically receives reports from managementour Chief Information Security Officer on these risks.risks every quarter. Because the Board and management recognize the importance of maintaining the trust and confidence of our employees, sales force, customers, vendors and other business partners, we have established an Information Security and Privacy group that has responsibility for executing a program to protect our data. This group identifies, tracks, and monitors risks in this area, and they follow standardizedour cybersecurity frameworks, includingprogram references the CIS Critical Security Controls and NIST-CSF, in measuringthe NIST Cybersecurity Framework (CSF) to guide our security risks.organization’s risk identification and mitigation procedures. We also have implemented a training program: all employees receive annualquarterly training, which is translated into multiple languages, and employees in elevated roles participate in more-frequent monthly training sessions. Wewe also conduct unannounced phishing simulation exercises to help our employees remain vigilant against cybersecurity threats. For more information about our cybersecurity risk management, strategy and governance, see “Item 1C. Cybersecurity” in our Annual Report on Form 10-K for the 2023 fiscal year.

Human Capital Management

Pursuant to its charter, our Compensation and Human Capital Committee oversees our human capital management. This committee discusses with and receives reports from our senior management at least annually regarding the development, implementation and headeffectiveness of Human Resources regardingour human capital management on a regular basis. Working with management,management. These reports typically include our Board’s committees overseeinitiatives regarding recruiting, career development and receive reports on matters including culture, compensation, benefits, key talent succession planning, employee engagement,progression, and diversity, equity and inclusion. Each year, ourinclusion (“DEI”). Our management also reportsprovides an annual report to the Executive Compensation Committeethis committee on management’s annual assessment of risks related to our compensation policies and practices. In addition, ourOur Nominating and Corporate Governance Committee conducts annual performance reviews foralso participates in our key executive officers, and these performance reviews include their performance on human capital management initiatives.by conducting an annual succession planning and management development session for our CEO and other executive management positions.

Our human capital objectives include the following:

Culture. All of our full- and part-time employees are responsible for upholding the Nu Skin Code of Conduct and for striving to perpetuate the Nu Skin Way, our global culture aspiration, which includes the following principles:

– A force for good – Accountable and empowered – Bold innovators – Customer obsessed | – Direct and decisive – Exceptional – Fast speed – One global team |

Hiring, Engagement, Development and Retention.We seek to hire and retain employees with the talents and capabilities to succeed at our company. The level of competition for qualified employees is high, owing to employment market trends both internationally and in Utah, where our corporate headquarters are located and which has one of the lowest unemployment rates in the United States. These conditions have made it more difficult for us to fill some job positions and retain employees. We address this issue by building a strong employer brand, allowing remote work options to reach potential employees in other locations, and providing competitive compensation and benefits. In addition, our hiring and retention efforts must be consistent with our overall business size and strategy. During 2023, we engaged in restructuring initiatives, in which we canceled some open job positions and reduced our employee headcount to enable us to operate more efficiently.

Developing our employees and keeping them engaged is crucial. We pursue these objectives by providing leadership training, encouraging managers to conduct one-on-one meetings with employees, holding town hall meetings to promote dialogue between management and employees, and reinforcing the Nu Skin Way forms the foundation of our human capital strategyto maintain an invigorating and objectives. The three primary objectives of our human capital strategy are:

Diversity, Equity and Inclusion.We believe a diverse, equitable and inclusive work environment allows us to benefit from unique perspectives and provides vitality, creativity, new ideas and growth. We are committed to our Diversity, Equity and Inclusion vision statement: “We are a force for good as we seek, develop, and empower diverse individuals and perspectives. We aspire to be a global community where every employee, entrepreneur, and consumer knows and feels they belong.”

We have established employee resource groups to help ensure that under-represented populations feel welcome at Nu Skin, including people of color, women and LGBTQIA+ individuals. Our Healthy Workplace Policy also aims to cultivate a culture of mutual respect and to provide all employees a work environment free from harassment, discrimination and unprofessional behavior. Our employees receive training on their responsibility in this important area, and we make a Healthy Workplace Hotline available for employees to report concerns anonymously.

We also incorporate DEI practices into our hiring process. We conduct training to create awareness of unintentional biases that may be present in the needshiring process. We work to ensure the wording of our employees. For example, after receiving employee feedback that pointed toward a needjob postings is inclusive and utilize multiple broad-based candidate search engines to establish a more comprehensive diversity, equityexpand our talent pools and inclusion strategy, we hired a global head of diversityincrease our access to diverse candidates.

Employee Health and inclusionWell-Being.Our employees’ health and began conducting a periodic "Listen and Learn" series of employee panels to bring our workforce into a more inclusive experience. These and other diversity-related initiatives have helped us to achieve employee engagement scores in the top quintile of global companies of a similar size.

Sustainability

Pursuant to its charter, our Nominating and Corporate Governance Committee oversees our sustainability initiatives, including social, climate and environmental matters. This committee reviews sustainability trends, discusses such trends with management, reviews our external sustainability reporting, and oversees our management of sustainability-related risks. Our Board and senior management areis also engaged in our sustainability initiatives, andas we endeavor to integrate sustainability-related risks and opportunities into our business strategy and operations. Our sustainability team reports regularly to our senior management and at least annually to our BoardNominating and quarterly to our senior management. Corporate Governance Committee.

Focusing on three key areas—product, planet and people—some of our sustainability initiatives are as follows:

– Assess, score and make plans to improve the environmental impact score of all of our products by the end of 2023 | ||

– Change all of our packaging to be recycled, recyclable, reusable, reduced or renewable by 2030 | ||

| Planet | – Reduce waste at our facilities through programs that encourage reducing, reusing and recycling, as well as initiatives to reduce electricity usage | |

| People | – Expand leadership development opportunities to – Donate 1 million products to partner organizations by 2025 |

Our 20202023 sustainability accomplishments include the following:

| – |

| – | We continued to make progress on our 2030 product-related goals. For example, the packaging for our Renu hair care line of products now uses either 100% recycled material or bioresin, a plant-based renewable alternative to traditional fossil fuel-based plastics. |

| – | We sourced all palm oil and palm oil-derived ingredients for personal care products from either the mass balance or book-and-claim models of the Roundtable on Sustainable Palm Oil. |

| – | Our ongoing environmental initiatives resulted in saving |

| – |

| – |

Board of Directors Meetings

The Board of Directors held eight meetings during 2020.2023. Each director attended more than 75% of the total Board and respective committee meetings for the period in which they served during 2020.2023. Although we encourage Board members to attend our annual meetings of stockholders, we do not have a formal policy regarding director attendance at annual stockholder meetings. All eightSix of our directors who were in office at the time of our 20202023 annual meeting of stockholders attended that meeting.

Board Committees

We have standing Audit, Executive Compensation and Human Capital, and Nominating and Corporate Governance Committees. Each member of the committees is independent within the meaning of the listing standards of the NYSE. In addition, the Audit Committee and the Executive Compensation and Human Capital Committee are composed solely of directors who meet additional, heightened independence standards applicable to members of these committees under the NYSE listing standards and rules of the Securities and Exchange Commission ("SEC"(“SEC”).

The following table identifies the current membership of the committees and states the number of committee meetings held during 2020.2023.

| Director | Audit | Executive Compensation | Nominating and Corporate Governance | Audit | Compensation and Human Capital | Nominating and Corporate Governance |

| Emma S. Battle | Chair | ✓ | ||||

| Daniel W. Campbell | ✔ | ✔ | ✓ | |||

| Andrew D. Lipman | ✔ | Chair | ✓ | ✓ | ||

| Laura Nathanson | ✔ | ✔ | ✓ | Chair | ||

| Thomas R. Pisano | ✔ | Chair | ✓ | |||

| Zheqing (Simon) Shen | ✔ | ✓ | ||||

| Edwina Woodbury | Chair | ✔ | Chair | ✓ | ||

| 2020 Meetings | 15 | 12 | 12 | |||

| 2023 Meetings | 8 | 6 | ||||

The Board has adopted a written charter for each of the committees, which are available in the “Corporate Governance”“Governance” section of our Investor Relations website at ir.nuskin.com.

Audit Committee

The Audit Committee’s responsibilities include, among other things:

| – | Selecting our independent auditor; |

| – | Overseeing the performance of our internal audit function and independent auditor; |

| – | Reviewing the activities and the reports of our independent auditor; |

| – | Approving in advance the audit and non-audit services provided by our independent auditor; |

| – | Reviewing our quarterly and annual financial statements and our significant accounting policies, practices and procedures; |

| – | Reviewing the adequacy of our internal controls and internal auditing methods and procedures; |

| – | Overseeing our compliance with legal and regulatory requirements; |

| – | Overseeing our risk assessment and risk management programs and plans related to our major financial risk |

| – | Conferring with the chairs of the Nominating and Corporate Governance Committee and |

The Board has determined that Ms. Woodbury and Mr. Campbell are Audit Committeeaudit committee financial experts as such term is defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC.

Compensation and Human Capital Committee

The Executive Compensation and Human Capital Committee’s responsibilities include, among other things:

| – | Establishing and administering our executive compensation strategy, policies and practices; |

| – | Reviewing and approving corporate goals and objectives relevant to the compensation to be paid to our CEO, Executive Chairman of the Board and other executive officers, evaluating the performance of these individuals in light of those goals and objectives, and determining and approving the forms and levels of compensation based on this evaluation; |

| – | Administering our equity incentive plans; |

| – | Overseeing our risk assessment and risk management programs and plans related to our compensation practices and human resources; |

| – | Overseeing the reporting of executive compensation information in accordance with applicable rules and |

| – | Overseeing our human capital management, including policies and strategies regarding recruiting, career development and progression, and diversity, equity and inclusion; and |

| – | Overseeing the administration and maintenance of our broad-based retirement and non-qualified deferred compensation benefit plans to the extent such functions have not been delegated to a management-level committee. |

Pursuant to its charter, the Executive Compensation and Human Capital Committee may delegate its authority to a subcommittee or subcommittees and may delegate authority to the CEO and Chairman of the Board to approve the level of incentive awards to be granted to specific non-executive officers, employees or other grantees subject to such limitations as may be established by the Executive Compensation and Human Capital Committee. For a discussion of the processes and procedures for determining executive and director compensation and the role of compensation consultants in determining or recommending the amount or form of compensation, see “Executive Compensation: Compensation Discussion and Analysis” and “Director Compensation.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s responsibilities include, among other things:

| – | Making recommendations to the Board of Directors about the size and membership criteria of the Board or any committee thereof; |

| – | Identifying and recommending candidates for the Board and committee membership, including evaluating director nominations received from stockholders; |

| – | Annually reviewing CEO succession planning as well as succession planning and management development for other executive officer positions; |

| – | Leading the process of identifying and screening candidates for a new CEO when necessary, and evaluating the performance of the CEO and Executive Chairman; |

| – | Making recommendations to the Board regarding changes in compensation of non-employee directors and overseeing the evaluation of the Board and management; |

| – | Developing and recommending to the Board a set of corporate governance guidelines and reviewing such guidelines at least annually; |

| – | Overseeing our risk assessment and risk management programs and plans related to our corporate governance risks, operational risks not assigned to the Audit Committee, |

| – | Overseeing our |

Board and Committee Evaluations

Our Board believes that a strong and constructive evaluation process is an important component of good corporate governance and helps to promote Board effectiveness. Our annual evaluation process, which is led by our Nominating and Corporate Governance Committee, focuses on both the Board and the Board committees.

The Nominating and Corporate Governance Committee reviews the format of our evaluation process each year to ensure that it remains robust and relevant. In 2020, weboth 2023 and 2024, the Nominating and Corporate Governance Committee used a third-party facilitator to assist in conducting the evaluation in order to receive fresh perspectives on Board effectiveness and corporate governance practices and to encourage candor in the evaluation process. The facilitator collected feedback from each director and then led a discussion at an in-person meeting.a Nominating and Corporate Governance Committee meeting to which our full Board was invited.

Our Director Nomination Process

As indicated above, the Nominating and Corporate Governance Committee of the Board of Directors oversees the director nomination process. This committee is responsible for identifying and evaluating candidates for membership on the Board and recommending to the Board nominees to stand for election.

Minimum Criteria for Members of the Board.

Each candidate to serve on the Board must possess the highest personal and professional ethics, integrity and values, and be committed to serving the long-term interests of our stockholders. In addition, our Bylaws and/or Corporate Governance Guidelines require| – | Resignation Bylaw for Majority Voting.Our Bylaws provide that an incumbent director shall be eligible for re-election only if she or he submits an irrevocable resignation that will be effective upon (i) such person failing to receive the required vote for re-election at the next annual meeting |

| – | Mandatory Retirement Age.A director who first joined our Board during or after 2023 shall not be eligible to stand for re-election after his or her 77th birthday unless the Nominating and Corporate Governance Committee determines that such director continues to meet the criteria for Board service and recommends to the Board that he or she stand for re-election notwithstanding his or her age. |

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating and Corporate Governance Committee may consider suchalso takes into consideration all other factors as it may deemconsiders appropriate which may include, without limitation, professional experience; diversitywith the goal of having a Board with diverse backgrounds, skills, and experience at policy-making levels in business, government, financial and other areas relevant to our global operations; experience and history with our company; and stock ownership.

We do not have a formal policy regarding the consideration of diversity in identifying Board nominees. However, our Board and our Nominating and Corporate Governance Committee believe that diversity is an important consideration in Board composition, as men and womenpeople of different skills,skills; areas of expertise and experience, races,experience; genders; and racial/ethnic, religious and cultural backgrounds can contribute different and useful perspectives to help the Board, as a group, to more effectively oversee our business.

Process for Identifying, Evaluating and Recommending Candidates.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders if properly submitted to the committee. Stockholders wishing to recommend candidates should do so in writing to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Nu Skin Enterprises, Inc., 75 West Center Street, Provo, UtahProcedures for Stockholders to Nominate Director Candidates at our Annual Meetings.

Stockholders of record may also nominate director candidates for our annual meetings of stockholders by following the procedures set forth in our Bylaws. Please refer to the section below titled “Stockholder Proposals forCommunications with Directors

Stockholders or other interested parties wishing to communicate with the Board of Directors, the non

-management directors as a group, the Lead Independent Director or any other individual director may do so in writing by addressing the correspondence to that individual or group, c/o Corporate Secretary, Nu Skin Enterprises, Inc., 75 West Center Street, Provo, Utah 84601. All such communications will be initially received and processed by our Corporate Secretary. Accounting, audit, internal accounting controls and other financial matters will be referred to our Audit Committee chair. Other matters will be referred to the Board, the non-management directors, or individual directors as appropriate.Additional Corporate Governance Information

We have adopted the following:

| – | Code of Conduct.Our code of conduct applies to all of our employees, officers and directors, including our subsidiaries. Any amendments or waivers (including implicit waivers) regarding the Code of Conduct requiring disclosure under applicable SEC rules or NYSE listing standards will be disclosed in the |

| – | Corporate Governance Guidelines.Our corporate governance guidelines govern our company and our Board of Directors on matters of corporate governance, including responsibilities, committees of the Board and their charters, director independence, director qualifications, director compensation and evaluations, director orientation and education, director access to management, director access to outside financial, business and legal advisors and management development and succession planning. |

Both of the above are available in the “Corporate Governance”“Governance” section of our Investor Relations website at ir.nuskin.com. In addition, stockholders may obtain a print copy of either of the above, free of charge, by making a written request to Investor Relations, Nu Skin Enterprises, Inc., 75 West Center Street, Provo, Utah 84601.

2024 Executive Officer Appointment

In addition to the executive officers identified in the “Information About Our Executive Officers” section of our Annual Report on Form 10-K for the 2023 fiscal year, we appointed Justin S. Keisel as our Executive Vice President and President of Global Sales in March 2024. Mr. Keisel, age 50, first joined our company in 1998, where for 14 years he primarily worked in roles supporting growth in our North Asia and Southeast Asia markets. In 2012, Mr. Keisel accepted an offer to work for Rodan + Fields, where he held several positions from 2012 to 2019, serving most recently as vice president of global programs and field development from 2017 to 2019. Mr. Keisel returned to our company in 2019 as General Manager of our United States and Canada markets and served in that position until 2021, when he was promoted to President of our Americas region, the position he held until his March 2024 promotion. Mr. Keisel holds B.S. and M.B.A. degrees from Brigham Young University.

DIRECTOR COMPENSATION

Our Nominating and Corporate Governance Committee is responsible for evaluating director compensation from time to time, and when it determines that adjustments are appropriate, it recommends them to the Board of Directors for its consideration. The Nominating and Corporate Governance Committee has retained the services of Semler Brossy Consulting Group LLC as its independent compensation consultant to assist in the review of our director compensation program, to provide compensation data and alternatives, and to provide advice as requested. For additional information regarding our independent compensation consultant, see “Executive Compensation: Compensation Discussion and Analysis—Analysis”—“Role of Compensation Consultant.”

The following table summarizes our non-employee director compensation program, which applies to each director besides Messrs. Lund and Wood because theywho does not receive compensation as an executive officersofficer or employee of our company. The amounts shown in the table shows the program as in effectwere implemented during 2020 and the changes that were approved in early 2021 following thea review of our director compensation program. No changes were made for 2022. Another review of the program was performed in early 2023, and will take effect as of June 1, 2021. The increases in retainers for leadership positions aimour Nominating and Corporate Governance Committee again determined not to more closely align with market practice. The increase in the annual equity award aims to better compensate the directors for an increased workload, particularlyrecommend any changes at the committee level, in a manner that maintains alignment with stockholder interests.time.

Non-Employee Director Compensation | ||||||

Annual cash retainer Board Committee | $85,000 $10,000 per committee | |||||

Additional annual cash retainer for leadership: Lead Independent Director Audit Committee Chair Other committee chairs | $25,000 $20,000 $15,000 | |||||

| Meeting fees | None(1) | |||||

| Annual equity award (restricted stock units) | $150,000 value |

| (1) | The Board can approve meeting fees for participation in a special committee or other extraordinary circumstances. |

In addition, we may compensate a director $1,500 per day for corporate events or some travel that we require, and we may reimburse directors for certainreasonable expenses incurred in attending Board and committee meetings and other corporate events. We also provide company products to our directors for theirpersonal and immediate family use.

Pursuant to the terms of our Third Amended and Restated 2010 Omnibus Incentive Plan, as well as our 2024 Omnibus Incentive Plan that will be submitted for stockholder approval at the Annual Meeting, the cash compensation and the aggregate grant date fair value (computed in accordance with applicable financial accounting rules) of awards under the Plan provided to any non-employee director during any single calendar year cannot exceed $750,000.

Director Compensation Table – 20202023

The table below summarizes the compensation earned by or paid to each of our directors in 2020person who served as a director during 2023 except Mr. Wood,Napierski, whose compensation is reported in the executive compensation tables. Mr. Wood servesNapierski served as a director, but as a company employee he receivesreceived no compensation for his services as a director.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | All Other Compensation ($)(2) | Total ($) |

| Emma S. Battle | 119,125 | 145,200 | — | 264,325 |

| Daniel W. Campbell | 135,000 | 145,200 | — | 280,200 |

| Andrew D. Lipman | 115,500 | 145,200 | 20,914 | 281,614 |

| Laura Nathanson | 123,000 | 145,200 | — | 268,200 |

| Thomas R. Pisano | 111,875 | 145,200 | — | 257,075 |

| Zheqing (Simon) Shen | 104,000 | 145,200 | — | 249,200 |

| Edwina D. Woodbury | 128,000 | 145,200 | — | 273,200 |

| Steven J. Lund | — | — | 856,608 | 856,608 |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | All Other Compensation ($)(2) | Total ($) |

| Daniel W. Campbell | 125,000 | 135,920 | — | 260,920 |

| Andrew D. Lipman | 130,000 | 135,920 | — | 265,920 |

| Laura Nathanson | 114,000 | 135,920 | — | 249,920 |

| Thomas R. Pisano | 124,000 | 135,920 | — | 259,920 |

| Zheqing (Simon) Shen | 96,500 | 135,920 | — | 232,420 |

| Edwina D. Woodbury | 129,000 | 135,920 | — | 264,920 |

| Steven J. Lund | — | — | 1,160,484(3) | 1,160,484 |

| (1) | On June |

As of December 31, 2023, none of the directors listed in the table above had any outstanding stock andawards or option awards held at December 31, 2020 by each ofbesides the listed individuals are as follows:restricted stock units noted in the previous paragraph.

| Name | Stock Awards | Option Awards |

| Daniel W. Campbell | 3,612 | 15,000 |

| Andrew D. Lipman | 3,612 | 15,000 |

| Laura Nathanson | 3,612 | — |

| Thomas R. Pisano | 3,612 | 10,000 |

| Zheqing (Simon) Shen | 3,612 | 5,000 |

| Edwina D. Woodbury | 3,612 | 5,000 |

| Steven J. Lund | — | — |

| (2) | This column reports our incremental cost for |

| – |

| – | The amount reported for Mr. Lund consists of Mr. Lund’s compensation as an employee of the company for |

EXECUTIVE COMPENSATION:

COMPENSATION DISCUSSION AND ANALYSIS

Our Compensation Discussion and Analysis (“CD&A”) describes our executive compensation programs and compensation decisions in 20202023 for our named executive officers (“NEOs”), who for 20202023 were:

| President and Chief Executive Officer | |

| Executive Vice President and Chief Financial Officer | |

| Executive Vice President and General Counsel | |

| Steven K. Hatchett | Executive Vice President and Chief Product Officer |

| Connie Tang | Former Executive Vice President and Chief Global Growth and Customer Experience Officer |

| Mark H. Lawrence | Former Executive Vice President and Chief Financial Officer |

| Joseph Y. Chang | Former Executive Vice President and Chief Scientific Officer |

References to our “Continuing NEOs” in this CD&A refer to all of the above NEOs other than Ms. Tang and Messrs. Lawrence and Chang, who, as discussed below, stepped down from their positions during 2023 (Ms. Tang and Mr. Lawrence) and in March 2024 (Mr. Chang).

Executive Summary

2023 Business Performance Highlights

In 2023, we continued to make progress toward our long-term vision of becoming the world’s leading integrated beauty and wellness platform. We believe much of our headway has been concealed by continued macro-economic pressures impacting consumer spending and customer acquisition in our markets, as well as disruptions associated with the ongoing transformation of our business. We finished 2023 at $1.97 billion of revenue with a challengingnegative foreign currency impact of 3% or $60 million.

Our overall 2023 results reflect a difficult year as consumers shifted purchasing habits toward lower-priced goods and services. On the other hand, our Rhyz segments achieved 41% year-over-year revenue growth in 2023 and more than 100% year-over-year revenue growth in the fourth quarter. Rhyz accounted for 11% of our 2023 revenue and continues to become a more meaningful part of the enterprise.

The Committee included four strategic goals in the annual incentive plan (25% weighting) to align incentives for our executives with key initiatives that underpin our multiyear strategic transformation. The four strategic goals in 2023 included new product revenue, adjusted gross margin improvement, sales channel growth, and monthly active users for our Stela and Vera mobile apps. These goals were to help advance the Nu Vision 2025 strategy by providing personalized beauty and wellness products including connected beauty devices, increasing affiliate-powered social commerce and expanding our digital platforms.

For 2024, we seek to generate long-term enterprise value by further transforming our core Nu Skin business and accelerating investment in our growing Rhyz ecosystem. To enhance this transformation, we reassessed our approach to capital allocation to invest in long-term growth and business evolution. This approach aims to grant us increased 7%financial flexibility, enabling us to effectively seize forthcoming growth opportunities. Moving forward, we will focus our investments across three key initiatives: 1) accelerating the growth opportunities in 2020Rhyz; 2) facilitating a new market expansion model beginning with India anticipated in 2025; and 3) furthering the build-out of our digital-first affiliate opportunity platform.

While we continue to $2.58 billion, while earnings per share improved 17% to $3.63. Bothnavigate the challenges of a business transformation amid these disruptive times, we have fine-tuned our customer and sales leader numbers improved during the year, increasing 34% and 29%, respectively. These improvements came as a result of focusing on our growth strategy and capitalizing on opportunities available to us through our prior investments in product innovation, technology and manufacturing to build our customer base and empower our sales leaders. We experienced strong growthremain confident in our Americas/Pacific, EMEA and Manufacturing segments. Additionally, we strengthened our balance sheet, repurchased more than five million shares of stock and increased our dividend for the 19th consecutive year.

2023 Named Executive Officer Changes

Executive Vice President and Chief Financial Officer.Mr. Wood informed the Board of Directors that he will retireLawrence resigned as CEO,Executive Vice President and Chief Financial Officer effective September 1, 2021. Mr. Wood has agreed to remain with our company through early 2022 to support the leadership transition by providing advice, guidance and assistance following the conclusion of his service as CEO.

Executive Vice President and Chief Global Growth and Customer Experience Officer. Ms. Tang resigned effective October 31, 2023, due to family health reasons. She is continuing to serve as a non-executive strategic advisor through April 2024.

Chief Scientific Officer.Mr. Chang retired as Chief Scientific Officer effective March 30, 2024.

Compensation Design Changes in 2023

Nu Vision 2025, which we introduced in January 2022, consists of a multiyear strategic transformation to becoming the world’s leading integrated beauty and wellness company that is powered by our dynamic affiliate opportunity platform. With that focus in mind, the Committee re-designed the cash incentive bonus plan for the remainderNEOs in 2023 to include four strategic goals that measured progress against Nu Vision 2025. The strategic goals had a total weighting of his time25%. The financial component constituted the remaining 75% weighting and, as with Nu Skin. The Committee also approved the grantpre-2023 Executive Cash Incentive Plan, continued to be split evenly between adjusted revenue and adjusted operating income.

For the long-term incentive component, to help ensure retention during our period of restricted stock unitsstrategic transformation, the weighting for time-based RSU awards was increased to Mr. Wood having a grant value of approximately $1,167,000 (approximately one-third of50% and the value of his typical award), reflecting his one remaining year of servicePRSU weighting was changed from 60% to our company. These restricted stock units will vest in full on February 15, 2022.50%.

Our Commitment to Pay for Performance

The primary objectives of our executive compensation program are:

| 1. | To successfully recruit, motivate and retain experienced and talented executives; and |

| 2. | To ensure pay for performance through incentives that |

| a. | Are tied to corporate and individual performance, |

| b. | Align the financial interests of our executives with those of our stockholders, and |

| c. | Are intended to drive superior stockholder value. |

The program, which is administered by theour Compensation and Human Capital Committee (the “Committee”), is intended to align actual compensation payments to actual performance and to adjust upward during periods of strong performance and downward when performance is short of expectations.

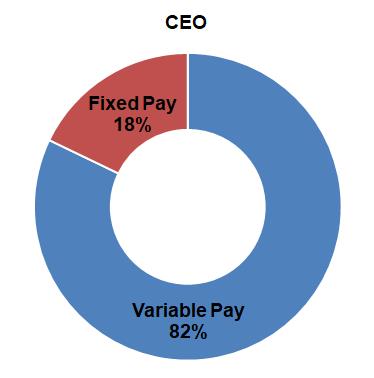

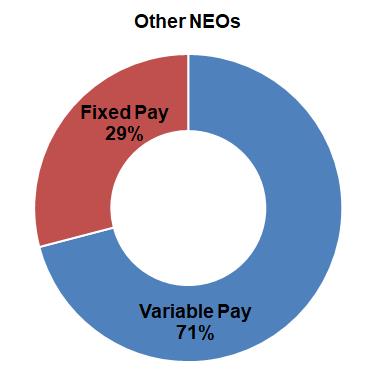

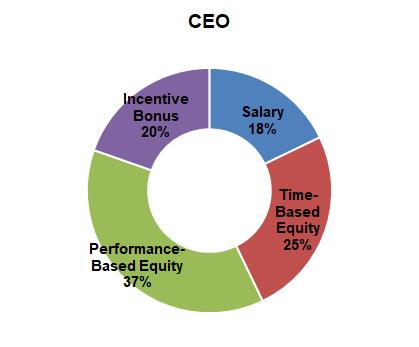

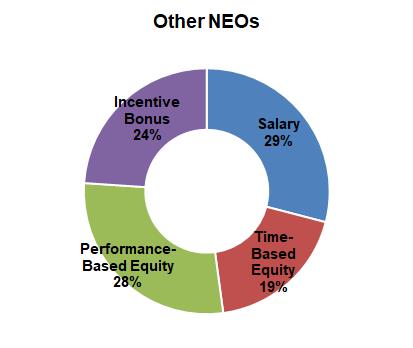

Our Continuing NEOs’ 20202023 target compensation was divided into variable compensation (cash incentive bonus and equity awards) and fixed compensation (salary) as follows:follows. Due to the CFO transition discussed above, the following “Other NEOs” chart reflects Mr. Thomas’s post-promotion target compensation, which, in the case of his equity awards, consists of the aggregate value of all equity awards he received during the year.

The following table describes the metrics upon which NEOs earn each component of variable compensation.

Cash Incentive Bonuses 17% of CEO 17% of Other | Long-Term Incentives 68% of CEO 59% of Other | |||

| Annual Incentive | Time-Based Restricted Stock Units (RSUs) 50% weighting | Performance-Based Restricted Stock 50% weighting | ||

| Measures one-year financial and operational performance | Measures four-year stock price performance | Measures one-year financial performance over three years | ||

Metric: Adjusted revenue | Metric: Adjusted operating income | Metric: Strategic goals | Metric: Stock price | Metric: Adjusted EPS |

| 25% weighting | ||||

| Incentivizes business growth | Incentivizes profitability and control of expenses | Incentives to drive our Company strategies for future growth and stockholder value | Aligns management with Promotes multi-year retention | Aligns management with stockholders’ interests Provides a balance to the top-line and operating-income metrics in the cash incentive bonus program |

| Final value of award tied to stock price. | Adjusted EPS is calculated to eliminate extraneous items such as the impact of accounting | |||

| Performance-Based Award | Percent of Target Earned |

| 59% | |

| 2022 PRSU Awards – Tranche 2 of 3 (measuring 2023 results)(2) | 0% |

| 2021 PSO Awards – Tranche 3 of 3 (measuring | 0% |

| (1) | Contingent on |

| (2) | Represents the tranches of the respective three-year awards that were contingent on |

2023 Say-on-Pay Vote

At our 20202023 annual meeting of stockholders, 98%99% of the votes cast were in favor of our executive compensation program. When designing our 20212024 executive compensation program, the Committee considered, among other things, the 20202023 voting results, and other feedback we received from our stockholders, which were viewed as supportive of our pay philosophy and incentive framework.

Continuing Adherence to Compensation Governance Best Practices

We have a framework of strong corporate governance related to compensation, illustrated as follows:

| What We Do | What We Don’t Do | |

✓Link pay outcomes directly to company and share price performance in support of a | ||

✓Utilize multiple, complementary incentive measures in the annual and long-term incentive plans that align with key drivers of stockholder value creation | ||

✓ Utilize double-trigger change in control benefits ✓ Employ a comprehensive clawback policy ✓ Require robust equity retention for directors and executives ✓ Assess compensation risk annually ✓ Engage an independent compensation consultant | ✗ No evergreen employment agreements ✗ No hedging or pledging of Nu Skin shares ✗ No excessive perquisites ✗ No excise tax gross-ups for NEOs ✗ No payment of current dividends on unvested equity ✗ No repricing of stock options without stockholder approval | |

Stockholder Outreach

We conduct stockholder outreach program, during 2020 we reached out to investors representing approximately 42% of our outstanding shares, generally covering holders of at least 1% of our outstanding shares.efforts periodically. We value the input of our stockholders, and the outreach process is an opportunity to:

| – | Solicit our stockholders’ feedback and better understand their perspectives on executive compensation so that the Committee can take those philosophies into account as it evaluates possible program changes; |

| – | Answer any questions that stockholders may have with respect to our existing programs and practices or past decisions; and |

| – | Establish a platform for ongoing dialogue with our stockholders. |

Compensation Design Changes in 2024

To continue supporting the multiyear strategic transformation to becoming the world’s leading integrated beauty and wellness company that is powered by our dynamic affiliate opportunity platform, in 2024 the Committee maintained the cash incentive bonus plan design for the Continuing NEOs. The only change for 2024 is to refresh the four strategic goals to help measure and navigate the challenges of our ongoing business transformation. The 2024 strategic goals focus on new product revenue, optimizing and reducing our number of SKUs, growth in our “paid affiliates” metric, and Rhyz revenue. Similar to 2023, the strategic goals will continue to have a total weighting of 25%. The financial component will constitute the remaining 75% weighting and will continue to be split evenly between adjusted revenue and adjusted operating income.

For the long-term incentive component, to help ensure retention during our period of strategic transformation, the weighting for both time-based and performance-based RSU awards continues to be at 50% each.

Compensation Overview

Objectives

The primary objectives of our compensation program are to:

| – | Successfully recruit, motivate and retain experienced and talented executives; |

| – | Provide competitive compensation arrangements that are tied to corporate and individual performance in the short- and long-term; |

| – | Align the financial interests of our executives with those of our stockholders; and |

| – | Drive superior stockholder value over the long-term. |

The Committee, in consultation with management and the Committee’s independent advisors, oversees the executive compensation and benefits program for the company’s NEOs. The compensation program is comprised of a combination of base salary, an annual cash incentive and equity incentives, each intended to support the above-noted objectives.

| Component of Compensation Program | Objective |

Base Salary (Fixed Pay) | – Pay for role – Aids in recruitment and retention |

| Cash Incentive Plan (Variable Pay: Short-Term Incentive) | – Pay for performance – Aligns with annual operating achievement – Aids in recruitment and retention |

| Equity Incentive Plan (Variable Pay: Long-Term Incentive) | – Pay for performance – Aligns with stock price performance and multi-year operating achievement – Aids in recruitment and retention |

We also provide retirement benefits in the form of a 401(k) plan and a deferred compensation plan, as well as limited perquisites and other personal benefits to executives that represent a small portion of their overall compensation.

Components of Compensation

For 2020,2023, our Continuing NEOs’ target compensation consisted of the following components:base salary; annual cash incentive bonus; equity awards; and retirement, perquisites and other benefits. Each of these components is discussed in detail below.

Base Salary

Base salaries are provided to reflect each NEO’s responsibilities, function, performance and competencies. In establishing and approving base salaries, the Committee considers various factors including:

| – | Current market practices and salary levels; |

| – | Each executive officer’s responsibilities, experience in their position and capabilities; |

| – | Individual performance and company performance; |

| – | The relative role and contribution of each NEO in the company; |

| – | Competitive offers made to executive officers and the level of salary that may be required to recruit or retain executive officers; and |

| – | The recommendations of the CEO. |

Base salaries for executive officers are typically reviewed annually in the first quarter of each year. The Committee does not assign specific weights to the factors identified above but generally endeavors to establish base salaries that are competitive in relation to the peer group median in order to attract and retain qualified and effective executive officers.

In the first quarter of 2020,2023, the Committee reviewed the base salaries of each of the NEOsour executive officers in connection with the established annual review process and determined to increase the salaries. The Committee also conducted additional, subsequent reviews of certain of the salaries by a range of 0%as needs arose due to 5%.the transitions in our NEO positions during 2023. The NEOs’ salaries together with the prior salaries thatin effect during 2023 were reviewed in the first quarter of 2020, are as follows:

| Name | Prior Salary ($) | Adjusted Salary ($) | Increase ($) | Increase (%) | Salary as of 12/31/2022 ($) | Adjusted Salary, Q1 2023 ($) | Salary as of 12/31/2023 ($) | |||||||

| Ritch N. Wood | 1,000,000 | 1,000,000 | — | — | ||||||||||

| Ryan S. Napierski | 950,000 | 1,000,000 | 1,000,000 | |||||||||||

| James D. Thomas | N/A | 400,000 | 450,000 | |||||||||||

| Chayce D. Clark | 450,000 | 550,000 | 550,000 | |||||||||||

| Steven K. Hatchett | 400,000 | 416,000 | 416,000 | |||||||||||

| Connie Tang | 620,000 | 640,000 | 640,000 | |||||||||||

| Mark H. Lawrence | 500,000 | 525,000 | 25,000 | 5% | 595,000 | 620,000 | N/A | |||||||

| Ryan S. Napierski | 700,000 | 725,000 | 25,000 | 4% | ||||||||||

| Joseph Y. Chang | 660,000 | 675,000 | 15,000 | 2% | 685,000 | 705,550 | 705,550 | |||||||

| D. Matthew Dorny | 510,000 | 510,000 | — | — | ||||||||||

Cash Incentive Bonus

Metrics.

Our Executive Cash| Metric | Weighting | Purpose | How Calculated |

| Adjusted revenue | Incentivizes business growth | ||

| Adjusted operating income | Incentivizes profitability and control of expenses | ||

| Strategic goals | 25% | Incentives to drive our Company strategies for future growth and stockholder value |

Our strategic goals consist of the following four goals, each of which is weighted at 6.25%:

| – | New product review.Revenue generated in 2023 by new products, including ageLOC LumiSpa iO, TRMe, ageLOC WellSpa iO and other cosmetic products. |

| – | Adjusted gross margin improvement.Measured as the year-over-year improvement in adjusted gross margin for 2023 compared to 2022, calculated with the same adjustments described above for adjusted revenue and adjusted operating income. |

| – | Sales channel growth.Sales channel growth refers to growth in the following sales force-related metrics: sales leaders, paid affiliates and passed letters of intent (LOIs), with each weighted at 2.083% for a total of 6.25%. We publicly report our sales leader and paid affiliate numbers each quarter; to calculate achievement for these metrics under the 2023 cash incentive program, our publicly reported quantities were used, reflecting fourth-quarter performance. Passed LOIs refer to the number of our affiliates who have notified us that they intend to pursue the business opportunity that we offer and are actively attracting consumers and building a sales network. To calculate achievement for this metric under the 2023 cash incentive program, we used the average quantity for October, November and December 2023. |

| – | Monthly active app users.This goal refers to the number of unique users that engaged with our Vera customer-focused app and our Stela business-focused app during the month of December 2023, with each app weighted at 3.125% for a total weighting of 6.25%. |

Cash incentive bonuses under our Executive Cash Incentive Plan are based on annual performance results and are paid annually after the end of each year. The cash incentive program that applies to our non-executive employees is divided between quarterly and annual results and has a quarterly payout opportunity. Mr. Thomas participated in our non-executive bonus program for the first half of 2023, prior to his promotion in July 2023. Accordingly, his aggregate bonus target and payout amounts for 2023 consisted of a mix of our non-executive and executive bonus programs.

Target Bonus.Cash incentive bonuses are computed based on the degree to which pre-determined goal performance levels are met or exceeded. If goal performance levels are met for a particular incentive period, a participant will earn a bonus equal to a pre-established percentage of year-end base salary, the “target bonus.” We set the target bonus as a percentage of base salary based on an executive officer’s position and responsibility and on market practices. The following table provides the target bonus percentagepercentages (as a percentage of salary) for each of our NEOs in 2020.2023.

Named Executive Officer | 2023 Target (End of Year) | |

| 110% | ||

| James D. Thomas | 75% | |

| Chayce D. Clark | 75% | |

| Steven K. Hatchett | 75% | |

| Connie Tang | 75% | |

| Mark H. Lawrence | ||

| Joseph Y. Chang | 75% | |

Calculation of Bonus: Achievement of Performance Goals and Potential Adjustment for Individual Performance.The precise percentage of target bonus that a participant will earn is based on the degree to which pre-determined performance levels are met or exceeded.

| – | If actual results for a particular incentive period equal: |

| ○ | Goal performance levels – The bonus amount will be the participant’s target bonus amount for the incentive period. |

| ○ | Minimum performance levels – The bonus amount will be 25% of the participant’s target bonus amount for the incentive period. |

| ○ | Stretch performance levels – The bonus amount will be 200% of the participant’s target bonus amount for the incentive period. |

| – | Payouts are interpolated linearly if actual results fall between the minimum and goal measurement points or between the goal and stretch measurement points. |

| – | If the minimum adjusted operating income performance level is not met, then (1) no bonus is paid |

| – | If the minimum adjusted operating income performance level is met, |

Notwithstanding the above methodology, the Committee may adjust an executive’s bonus based on factors it considers relevant, including individual performance and certain compliance-related objectives. The Committee did not exercise this discretion with respect to 20202023 bonuses.

Establishment of 20202023 Performance Goals.

2023 Goals, Performance and Payout.

The following table| (dollar amounts in thousands; adjusted gross margin improvement in basis points) | ||||||

| Metric | 2023 Targets | 2023 Result (1) | % of Goal Level Achieved | % of Target Bonus Paid (2) | ||

| Minimum | Goal | Stretch | ||||

| Financial Goals - 75% weighting, split evenly between the two metrics | ||||||

| Adjusted revenue | $1,891,000 | $2,114,000 | $2,338,000 | $2,019,004 | 95.5% | 68.1% |

| Adjusted operating income | $127,000 | $178,000 | $216,000 | $156,009 | 87.6% | 67.7% |

| Strategic Goals - 25% weighting, split evenly among the four metrics | ||||||

| New product revenue | $300,000 | $400,000 | $500,000 | $283,708 | 70.9% | 0.0% |

| Adjusted gross margin improvement (basis points) | 0 | +20 | +30 | (70) | 0% | 0.0% |

| Channel growth | ||||||

| Sales leaders | 40,000 | 50,000 | 60,000 | 44,059 | 88.1% | 55.4% |

| Paid affiliates | 225,000 | 250,000 | 285,000 | 166,886 | 66.8% | 0.0% |

| Passed LOIs | 15,000 | 18,000 | 21,000 | 9,372 | 52.1% | 0.0% |

| Monthly active app users | ||||||

| Vera customer app | 200,000 | 250,000 | 300,000 | 114,641 | 45.9% | 0.0% |

| Stela business app | 50,000 | 65,000 | 80,000 | 83,234 | 128.1% | 200.0% |

| Aggregate payout percentage, reflecting the weightings noted above: | 58.3% | |||||

| (dollar amounts in thousands) | ||||||||

| Metric | 2019 Result | 2020 Targets | 2020 Result | % of Goal Level Achieved | % of Target Bonus Paid | |||

| Minimum | Goal | Stretch | ||||||

Adjusted revenue (50% weighting) | $2,420,416 | $2,175,000 | $2,420,000 | $2,662,000 | $2,594,120 | 107.2% | 172.0% | |

| Adjusted operating income (50% weighting) | $267,426 | $177,000 | $217,000 | $293,000 | $254,436 | 117.3% | 149.3% | |

| Aggregate payout percentage, reflecting the weightings noted above: | 160.6% | |||||||

| (1) | As compared to our 2023 reported revenue and operating income, our 2023 adjusted revenue and operating income reflect adjustments for foreign-currency fluctuations and the impact our acquisitions of Beauty Biosciences, LLC and LifeDNA, Inc. during 2023 (the results of which were not contemplated in our 2023 targets). Our adjusted operating income also reflects adjustments for an inventory write-off, restructuring and impairment charges, an accrual for a legal contingency and a non-recurring foreign tax charge. |

| (2) | Calculated based on the linear interpolation of actual 2023 results between the minimum and goal targets (which correspond to the 25% and 100% payout levels, respectively) where applicable. Achievement of our goals for Stela monthly active app users was above the stretch target. |